Ohio state paycheck calculator

Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Ohio paycheck calculator. Click here for a larger sales tax map or here for a sales tax table.

Income General Information Department Of Taxation

Minnesota Paycheck Calculator.

. Whistleblower Policy Policy 140. Send us a message. Immovable property of this nature.

An interest vested in this also an item of real property more generally buildings or housing in general. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. This table shows the top 5 industries in Nebraska by number of loans awarded with average loan amounts and number of jobs reported.

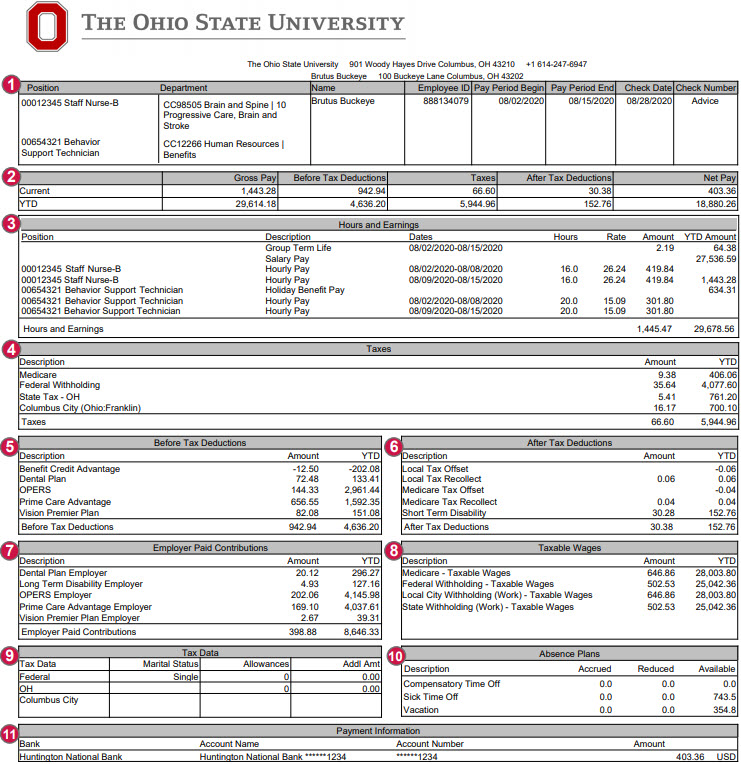

614 247-myHR 6947 Fax. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. How Your Ohio Paycheck Works.

The tool below can be used to search all publicly released PPP recipients in OH. Our paycheck calculator is a free on-line service and is available to everyone. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This number is the gross pay per pay period. Texas tax year starts from July 01 the year before to June 30 the current year.

The calculator will show you approximately how much you should contribute each paycheck to reach your desired retirement goal. That ranks in the top half of the nation. Texas state income tax.

Payroll check calculator is updated for payroll year 2022 and new W4. Nebraska has a total of 114204 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. Minnesota tax year starts from July 01 the year before to June 30 the current year.

If you consistently find yourself owing. Switch to Ohio hourly calculator. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Unlike the Federal Income Tax Ohios state income tax does not provide couples filing jointly with expanded income tax brackets. So the tax year 2021 will start from July 01 2020 to June 30 2021. Calculating your Ohio state income tax is similar to the steps we listed on our Federal paycheck calculator.

In terms of law real is in relation to land property and is different from personal property while estate means. Paycheck calculators by state. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Ohio has a total of 352307 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. Free Federal and State Paycheck Withholding Calculator.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. The section below is where you specify how much you want to contribute. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Payroll check calculator is updated for payroll year 2022 and new W4. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes.

The savings amount will be populated as a starting point. Ohio tax year starts from July 01 the year before to June 30 the current year. Ohios maximum marginal income tax rate is the 1st highest in the United States ranking directly below Ohios You can learn more about how the.

This table shows the top 5 industries in Ohio by number of loans awarded with average loan amounts and number of jobs reported. Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2022 tax year on Aug 02 2022. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

When considering the state sales tax rate of 575 and county rates as high as 225 the average total sales tax rate in Ohio is about 717. How You Can Affect Your West Virginia Paycheck. However some sales tax exemptions in Ohio should help seniors limit the amount of.

Combined with the state sales tax the highest sales tax rate in Ohio is 8 in the cities of. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas.

Has standard deduction and exemption if you have dependents From Wikipedia. If you have a disability and experience difficulty accessing this site please contact us for assistance via email at hrconnectionosuedu or by phone at 614-247. No state payroll taxes.

No personal information is collected. State and local income tax rates. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

Use the goal slider to see the impact of the different retirement goals. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225There are a total of 576 local tax jurisdictions across the state collecting an average local tax of 1504. Box 1140 Columbus OH 43215 or Fraud Hotline at 866 372-8364.

Subtract any deductions and payroll taxes from the gross pay to get net pay. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. The Ohio State University Human Resources HR Connection.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. So the tax year 2022 will start from July 01 2021 to June 30 2022. Ohio Auditor of State Special Investigations Unit 88 E.

Ohio Paycheck Calculator Adp

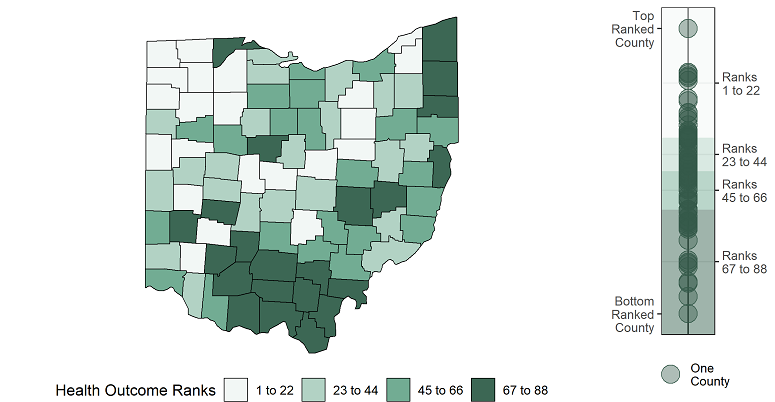

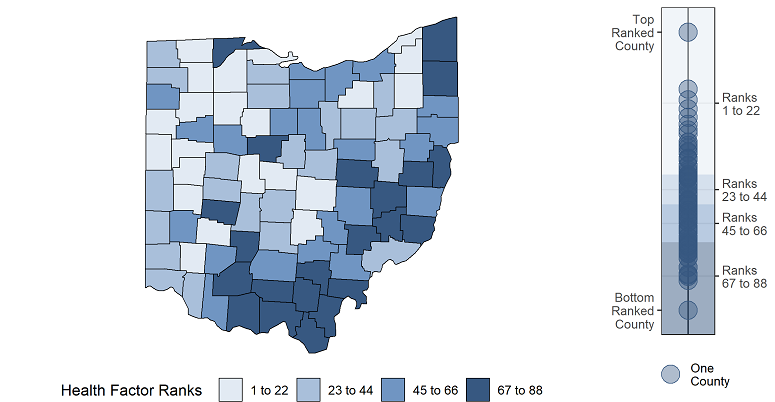

2022 Ohio State Report County Health Rankings Roadmaps

Ohio Tax Rate H R Block

Ohio Paycheck Calculator Adp

Frequently Asked Questions Office Of Business And Finance

Ohio Paycheck Calculator Tax Year 2022

Ohio Paycheck Calculator 2022 With Income Tax Brackets Investomatica

View W 2 W 2c Forms Wage And Salary Information Buckeyelink

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Annual Budget Template Debt Snowball Calculator Personal Finance Bundle Excel Video Video Budgeting Monthly Budget Template Budget Spreadsheet

2

Ohio Paycheck Calculator Smartasset

Ohio Salary Calculator 2022 Icalculator

Ohio Paycheck Calculator Smartasset

2021 Ohio State Income Taxes Done On Efile Com In 2022

2022 Ohio State Report County Health Rankings Roadmaps

Ohio Payroll Services And Regulations Gusto

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation